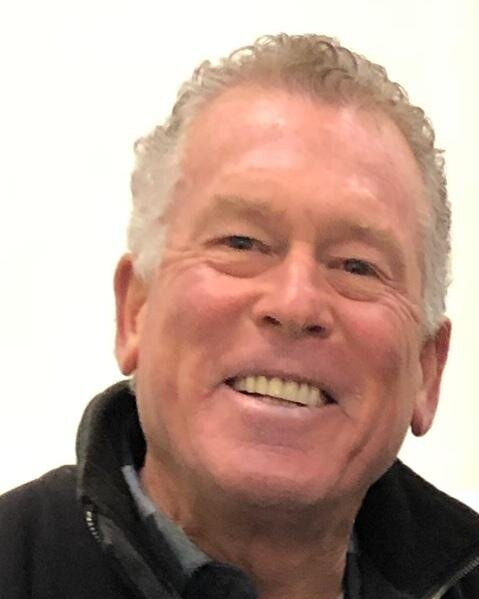

DAVID GOLDFISHER

Co-Founder, Principal

David brings 30 years of talent and experience in the Commercial Mortgage-Backed Securities (CMBS) industry, achieving exceptional success on both sides of the lending table.

TAMMY GILBERT-GOLDFISHER

Co-Founder, Principal

With over 30 years of experience in commercial real estate finance, Tammy champions sophisticated data analysis and customized solutions for The Henley Group’s clients.

DAVID ARTHUR

Senior Managing Director - Head Underwriter

With over 35 years of experience in commercial real estate, David brings unparalleled depth, breadth, and senior leadership to CMBS advisory services.